Stop Loss Order

Perhaps the most common of all orders, and the one most familiar to new traders is the stop loss. An automated instruction to reverse an open position at a certain point, stop losses are usually an added extra with trading platforms, but the role they provide can be absolutely crucial in minimising your exposure to risk and freeing up your time to invest your remaining capital in other positions without the need to keep a constant eye on the performance of every single one of your positions.

Envisage running a trading portfolio with several hundred contracts for difference open at any one time. Positions would constantly by ticking – some up, some down – and you would be required to keep an eye on those positions that are losing you money so you can close them out as quickly as possible.

In the meantime, you’d be required to keep abreast of the latest developments affecting your industries and sectors, while also identifying trends, analysing performance data and making tactical decisions based on your findings. Without stretching the imagination too much, it becomes quite easy to see the logistical nightmare which can present itself with even moderately sized trading portfolios.

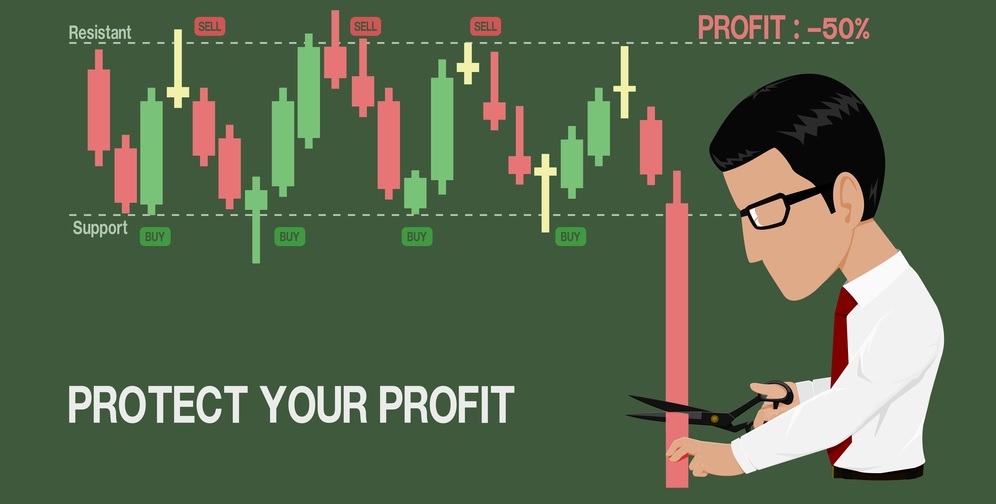

Where the stop loss comes in is in minimising the losses of any one position, and in automating the process of cutting out of positions when they reach a certain point below the value at which the contract was opened. In essence, a stop loss is an instruction to reverse a trade when it hits a certain trigger point, usually below which your CFD would start to incur more significant liability from your trading portfolio.

Because CFDs usually attract unlimited liability for losing positions, and brokers have an enforceable contractual right to collect monies owed to them as a result of unpaid margin calls, it’s vital that you take every available step to prevent losing fortunes on positions that don’t go your way, and the stop loss is the number one way of preventing that from happening.

A Short Example of Using Stop Loss and Stop Limit

A good rule of thumb with a stop loss is to set it on or just below the recent low point of the underlying asset’s price. Say Company X securities haven’t fallen below $1.00 in the last 6 months, and are currently sitting at $1.10 – you might choose set a stop loss at $0.99, assuming that if the price hit this new low it may be moving into unchartered territory and may not recover to recoup your liability. At the same time, a trader might want to be happy to close at $1.50 so stop limit order will collect the profit the moment the price of Company X hits the target.

Of course, you intend for the position to perform well over time even if it ticks downwards on a few occasions over the duration of its open period – so it’s important not to set the stop at $1.09, otherwise the transaction will prematurely close and you’ll foot the costs of the trading commission and financing and lose money on an otherwise promising trade. With stop loss orders, it’s about finding the right balance between risk minimisation and allowing the natural cycles of asset price movement freedom to breathe.

In Essence: Stop Loss Order is used to limit your losses when the market moves against you.

Stop Limit Order

Of course, a stop loss is only a useful tool for minimising liability in long positions with CFDs. Taking a short position on a particular contract will leave you requiring a different type of order to close out and minimise your losses – known as a stop limit. Stop limits perform the exact same function as stop losses, only that they sit above the current share price, and they can be used as a means of securing a certain level of profit from a long trade as well as handling exposure to risk.

In Essence: Stop Limit Order is used to collect a profit when your profit target is hit.

Applying Stop Loss and Stop Limit

Both stop losses and stop limits can be applied to long and short positions, but their effect in either maximising revenue or minimising profit is reversed depending on whether you’re going long or short. Obviously when limiting your profit that can have drawbacks, but providing the order is set at the right level it can be a great way to cash out at the top before the underlying asset price heads south.

Stop losses and stop limits play a crucial role in any trading portfolio, and are an essential part of the successful forex and CFD trader’s arsenal. Whether it’s on the upside or the downside, orders take out much of the hassle from maintaining your open positions, and provide a guaranteed get out point when certain trades don’t go your way.

Leave a Reply